The purpose for control of concentrations is to ensure conditions of competition in product markets and market structures open to competition. The Competition Authority will intervene in a concentration only if the concentration may significantly impede effective competition in the Estonian markets or in a substantial part thereof, especially as a result of the creation or strengthening of a dominant position in the market. The primary way to avoid restriction of competition is to impose conditions on the parties to the concentration to fulfil their obligations, such as the obligation to divest part of their business, etc. However, a concentration may be prohibited if the obligations taken are not sufficient to prevent restrictions of competition or if the parties to the concentration do not propose assuming obligations. The parties to the concentration also have the opportunity to abandon the proposed concentration. If the parties to the concentration abandon the concentration, the Competition Authority shall terminate the concentration proceedings.

The concentration must be notified to the Competition Authority after the conclusion of the agreement, the conclusion of a transaction, or act for the acquisition of control or the announcement of a public offer, but before the entry into force of the concentration. A concentration may also be notified to the Competition Authority as soon as the parties indicate with sufficient certainty their intention to complete the concentration. The control applies to concentrations between undertakings if the total turnover of the parties in Estonia in the previous financial year exceeds 6,000,000 euros, and the turnover of at least two parties to the concentration in Estonia each exceeds 2,000,000 euros. A concentration that must be controlled by the Competition Authority may not be enforced until a decision approving the concentration has been made.

During 2020, the Competition Authority had a total of 38 concentration control proceedings, of which 36 concentration notifications were submitted in 2020, and 2 notifications were transferred from 2019. At the same time, 28 decisions to grant permission to concentrate were made within the 30 days prescribed by law, four concentration proceeding decisions were made to initiate supplementary proceedings. Supplementary proceedings will be carried out to gather additional information and to determine whether there are circumstances restricting competition in case of concentration of the subject to control. According to the law, the length of supplementary proceedings may be up to four months. In the course of supplementary proceedings initiated in 2020, the parties to the concentration abandoned the concentration in one case (MM Grupp OÜ and Forum Cinemas OÜ), and in three cases (Alexela Varahalduse AS, OÜ 4E Biofond and Eesti Biogaas OÜ; aktsiaselts SEMETRON and osaühing InBio; USS Security Eesti AS and SECURITAS EESTI AKTSIASELTS) a permission to concentrate was granted by the Competition Authority.

By type of concentration, the concentrations were as follows:

32 concentrations involved the acquisition of control by an undertaking over another undertaking or a part thereof (clause 19 (1) 2) of the Competition Act);

4 concentrations concerned the acquisition of joint control by undertakings over a third undertaking or a part thereof (clause 19 (1) 3) of the Competition Act).

|

|

Question of timeliness in the court action concerning the concentration of OÜ R-S Valdus and Aktsiaselts Väätsa Prügila

In 2020, the so-called dispute over timeliness concerning the decision prohibiting the concentration of OÜ R-S Valdus / Aktsiaselts Väätsa Prügila was resolved, this provided additional clarity regarding the interpretation of subsection 28 (31) of the Competition Act.

The Competition Authority had prohibited the merger of OÜ R-S Valdus and Aktsiaselts Väätsa Prügila with its decision No. 5-5/2018-058 of 21 September 2018. OÜ R-S Valdus filed an appeal with the Tallinn Administrative Court to annul the decisions of the Competition Authority and to establish the admissibility of the concentration. OÜ R-S Valdus also found that the Competition Authority did not make a decision prohibiting the concentration in a timely manner. In the court proceedings, the dispute over the timeliness of the decision was separated from the dispute over the substance of the decision.

The dispute over the term of the decision arose from the question of how to interpret subsection 28 (31) of the Competition Act only after the merger proceedings. In a situation where the Competition Authority has come to the conclusion in the course of proceedings that the concentration may significantly distort competition and has notified the parties to the concentration pursuant to subsection 28 (1) of the Competition Act, the parties to the concentration have the opportunity to propose to assume obligations.

Pursuant to subsection 28 (31) of the Competition Act, the term of the concentration proceedings is suspended if the obligations to be assumed require additional analysis or if the parties to the concentration agree to amend or supplement the obligations to be assumed. The proceedings shall be suspended as of the date following the date of sending the relevant notice to the Competition Authority, and the term shall continue to run from the day of receipt of the offer. The term of the proceedings may be suspended once and for up to two months. The purpose of the provision is to allow an opportunity to analyse in more detail the impact of the commitments on the prevention of distortion of competition and to prevent situations where the lack of time does not allow to make the most appropriate decision considering the circumstances of the case. At the same time, extending the term is subject to the agreement of the parties to the concentration and thus does not harm the interests of the undertaking.

In the present case, the dispute over timeliness essentially shifted to the question whether, in a situation where the Competition Authority had suspended a proposed concentration and the parties to the concentration submitted new, alternative obligations (clearly expressing their willingness to accept previously submitted obligations and amend proposed obligations), the term of the proceedings would continue to run from the submission of a proposal for the final (amended or supplemented) obligations or any alternative obligations. The Competition Authority was of the opinion that the term of the proceedings can continue after notice has been given of the results reached during the analysis of the proposed obligations if the party to the concentration submits a new final proposal for obligations to be assumed.

Both the Tallinn Administrative Court and the Tallinn Circuit Court supported the position of the Competition Authority and found that the Competition Authority had made a decision prohibiting the concentration of OÜ R-S Valdus and Aktsiaselts Väätsa Prügila in a timely manner.

Concentration of MM Grupp and Forum Cinemas OÜ

The Competition Authority was processing a notification from of a concentration during the period of 21 September 2020 to 19 February 2021 according to which MM Grupp OÜ intended to acquire control over Forum Cinemas OÜ. The Authority terminated the concentration proceedings due to MM Grupp OÜ deciding to abandon the concentration. Prior to that, the Authority had reached the conclusion that the concentration was likely to significantly impede competition.

Both parties to the concentration are screening films in cinemas. Apollo Kino OÜ, which is under the control of MM Grupp OÜ, operates 10 cinemas in Estonia, including four cinemas in Tallinn (Solaris Centre, Mustamäe Centre, Ülemiste Centre and O´Learys Cinema Restaurant in Kristiine Centre), two cinemas in Tartu and one cinema in Pärnu, Saaremaa, Narva and Jõhvi. Forum Cinemas OÜ operates 3 cinemas in Estonia (Coca-Cola Plaza in Tallinn, cinema Ekraan in Tartu and cinema Centrum in Viljandi). MM Grupp OÜ also distributes motion pictures. Distribution of motion pictures is to the upstream market of the screening of films in cinemas, i.e. a seller-buyer relationship exists.

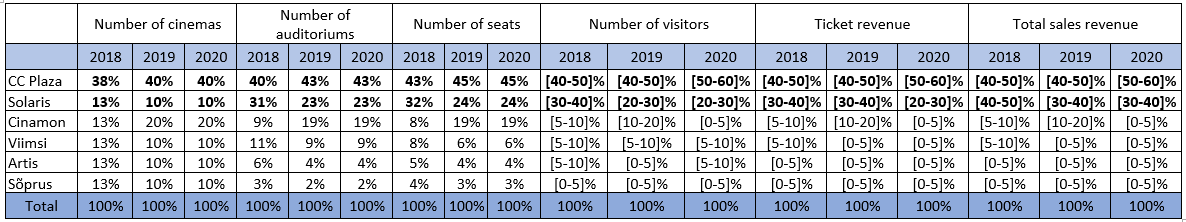

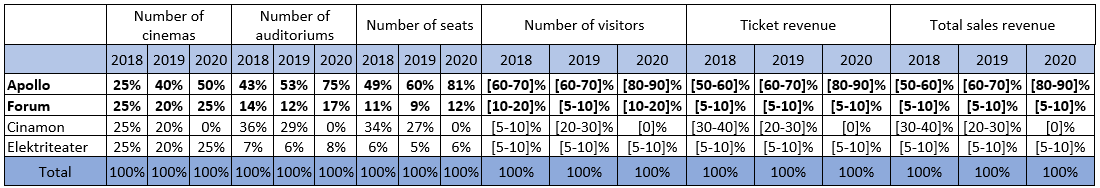

The activities of the parties to the concentration in screening films in cinemas overlap geographically in Tallinn and its vicinity and in Tartu. In assessing the competition situation in Tallinn and its vicinity, the Competition Authority included the cinema in Viimsi, which is near Tallinn, on the same product market as other cinemas. The following tables show the market shares of the parties to the concentration and other market participants.

Market shares in Tallinn and its vicinity

Market shares in Tartu

In the table of market shares in Tartu, Cinamon’s data for 2020 has been annulled in order to simulate the situation that exists in the product market for screening films in cinemas in Tartu after the closure of the Cinamon cinema. Cinema Cinamon operated in Tartu until 1 September 2020.

As a result of the assessment of the concentration, the Authority found that the concentration would significantly impede competition in the film screening markets of Tallinn and the surrounding area and of Tartu. As a result of the concentration, the undertaking acquiring the other business operator would acquire its main competitor, i.e. the greatest source of competitive pressure would leave the product market. In the already highly concentrated product markets, the product markets would become even more concentrated, and as a result of the concentration, the merged entity would have a position close to being a monopoly in Tallinn and its vicinity and in Tartu.

Additionally, the Competition Authority established that MM Grupp OÜ has grown into the largest market participant in the distribution of motion pictures in Estonia. According to the Authority, this vertical link would exacerbate the distortion of competition with the opportunities offered by foreclosing the distribution services market (input market) for competing cinemas and foreclosing the motion picture purchasing market (customer market) for competing film distributors.

The Competition Authority also analysed the information provided during the proceedings on Forum Cinemas OÜ’s financial difficulties and possible exit from the product market and found that it could not be stated with sufficient confidence that without the concentration, the competitive structure in the market would weaken at least to the same extent.

The parties to the concentration submitted proposals for obligations to be assumed in order to eliminate the competition issues identified by the Competition Authority. The proposals included both obligations to transfer some of the cinemas of the parties to the concentration and a behavioural non-discrimination obligation to alleviate competition issues in the distribution of motion pictures. The Competition Authority assessed the proposed obligations not to be sufficient.

The Competition Authority notes that although this is a difficult period for the entertainment sector due to COVID-19, this is not a reason to permit concentrations that distort competition and have a negative long-term effect on the structure of the product market to be approved.

As a result, the concentration proceedings were terminated as the parties to the concentration withdrew the notification.