Electricity consumption in Estonia with grid losses is 8,966 GWh per year. Final consumption, excluding network losses, is 7,847 GWh, of which 26.3% is accounted for by household customers. Domestic production accounts for 6,312 GWh of the electricity balance, imports for 7,464 GWh, and exports for 4,832 GWh. Electricity consumption is expected to continue to grow, as the degree of electrification is increasing in various sectors. The total electricity price paid by the consumer is made up of the price of electricity as a commodity, a network charge, an excise duty, and a renewable energy charge. VAT is also added to the price of a household customer. Electricity prices are set under free market conditions, network charges are coordinated ex ante by the Estonian Competition Authority, and excise duty and renewable energy charge are set by law.

The Estonian electricity sector is characterised by a very strong dependence on the power exchange and bilateral contracts are not common. The market structure has also changed dramatically – while ten years ago, the state-owned Eesti Energia was almost the only producer, then today, there has been a steady increase also in the amount produced or imported by the private sector. Ensuring competition between wholesalers and retailers is essential in today’s free market.

Since 2021, the issue of independence of the distribution network has been in sharp focus. The role of the electricity distribution network is becoming increasingly important. Consumption managers, producers and storage capacity providers must be guaranteed the possibility to participate in electricity markets and to offer different products to network operators on a market basis – reserve capacities, constraints management, voltage control, etc. Network operators need to ensure that reserves are procured and network constraints are managed on the basis of market principles, rather than building a too strong network or owning reserve products, which is ultimately more costly for the society.

Supervision proceedings in connection with a power outage of Elektrilevi AS in Jõgeva

On 27 April 2021, a fire occurred at the Jõgeva regional substation, resulting in a large-scale power outage. As a result of the supervision proceedings carried out in connection with this, the FCA Estonian Competition Authority established that Elektrilevi AS violated the quality requirements for network services regarding the duration of the interruption of network connection. The Estonian Competition Authority supervises compliance with the quality requirements for network connections pursuant to the Electricity Market Act and Regulation No. 42 of the Minister of Economic Affairs and Communications of 6 April 2005 ‘Quality requirements for network services and conditions for the reduction of network charges in the event that those quality requirements are violated’.

Elektrilevi AS acknowledged that in the case of the interruption in Jõgeva, the established requirements for 3,119 customers were exceeded and therefore, the network charges of customers were reduced by 24,920.81 euros, which is on average eight euros per customer.

The authority recommended Elektrilevi to review the work and composition of the Information Centre for Crisis Management to be set up for handling power outages, so that informing the public about power outages and their effects is carried out in accordance with the principle of equal treatment and is uniform for electricity sales companies.

There were also problems in communicating with the local government in eliminating the power outage. The proceedings revealed that the communication principles between Elektrilevi and local governments are incomplete or non-existent. Therefore, the authority recommended Elektrilevi, in cooperation with the Ministry of Economic Affairs and Communications, the Rescue Board, local governments, and vital service providers, to develop specific principles on the basis of which communication takes place in the event of major power outages.

Proposal of the Competition Authority for a review of renewable energy subsidies

The Estonian Competition Authority once again made a proposal in 2021 to the Ministry of Economic Affairs and Communications to review the renewable energy subsidies. In the light of the rise in electricity prices, it is justified to review the conditions and amounts of the current renewable energy subsidies. It is possible that the amount of renewable energy subsidies is no longer in line with the purpose of the once granted subsidies.

The price of electricity has sharply increased throughout Europe in 2021, including in Estonia. The price increase has been mainly influenced by the increase in natural gas prices, consumption growth, the price of the CO2 quota, the price of coal, the low level of renewable energy production, and other factors. Renewable energy production in Estonia is financed by a renewable energy charge included in the electricity bills of consumers. In the period of 2007–2020, consumers paid a significant 827.9 million euros for the production of renewable energy.

One of the most important factors in making investment decisions is the potential return. The investment decisions made in the production of renewable energy have been based on the stock exchange price of electricity valid at that time and the possible subsidies for renewable energy. As the price of electricity has increased sharply in 2021, the Estonian Competition Authority recommended reviewing the current subsidy amounts and bringing them in line with the stock exchange price of electricity.

Electricity price analysis

The Competition Authority examined the reasons for the increase in electricity prices. Throughout 2021, the price of electricity was on the rise in European markets, with a surge in the second half of the year. The price rise hit the entire Europe, including the Baltic region. While the average price increase over the year was 157.4% (average price in 2020 was 33.7 €/MWh compared to an average price in 2021 of 86.7 €/MWh), the monthly price increases were even higher in the autumn/winter period. The average price of electricity in Estonia was €105.6/MWh in October 2021, compared to €37.6/MWh in October 2020, being a change of 181%. In a December comparison, the price gap with the previous year had already widened by a factor of 4.5 (average price of €45.5/MWh in December 2020, compared to an average price of €202.7/MWh in December 2021).

In an open electricity market, market participants can trade electricity in two ways — on the basis of direct contracts or by participating in a power exchange. Direct contracts are based on bilaterally agreed terms and conditions, which means that the price of electricity depends to a large extent on the prices offered as financial services or directly on energy prices on the power exchange. Direct contracts are typically concluded between a large user and a producer to minimise additional transaction costs. In Estonia, direct electricity purchase/sale contracts can only be concluded domestically, as the entire transfer capacity of connections is placed on the market. However, the share of direct contracts is not high and most of the trading takes place on the power exchange, i.e. the public wholesale market. Producers, network operators, sellers, brokers, i.e. anyone who signs a contract with an exchange operator, can trade on the power exchange. The price calculation model used plays an important role in the operation of the electricity market. Today, the Single European Market uses a zonal pricing model, which also takes into account the actual transfer capacities between regions.

Estonia and the other Baltic countries are part of a single European electricity market. The Single European Electricity Market means that there are multiple connections between different price areas, and electricity goes from a lower-priced area (more production) to a higher-priced area (more consumption) according to the capacity of the connections between the areas. The day-ahead electricity market is a part of the electricity market where electricity supplied on an hourly basis the next day is traded on the power exchange. The price of electricity is determined on the basis of the marginal pricing principle for each hour on the basis of bids made during a specific agreed period. The day-ahead market price is the most important indicator for consumers, and is also the basis for the exchange packages. On the day-ahead market, prices are calculated for the whole of the Single European Electricity Market, with price differences between regions occurring when the capacities of interconnectors between regions are fully utilised. Electricity trade is thus organised through power exchanges. The day-ahead market price for electricity is influenced by the bid price for production capacity, the demand for electricity, i.e., consumption and purchase offers for consumption. At the equilibrium point of the supply and demand curves, a market price for electricity is established.

The analysis showed that the most important cause of the electricity price increase was the surge in natural gas prices (396% year-on-year in Europe and 269% in the Baltic States). In addition, electricity demand increased by an average of 4% and CO2 prices doubled, while the weather had an impact on hydro reservoir volumes.

In the light of high energy prices, the authority has again recommended that the conditions and amounts of the renewable energy subsidy be reviewed and linked to the power exchange price. In addition, it is important to strengthen market monitoring and to anticipate risks related to security of supply. In the context of Estonia and the Baltic States, it is important that the sellers of electricity are ensured the possibility to cover their wholesale market price risks efficiently with futures transactions. This will give electricity traders the possibility to offer longer term and lower fixed price contracts on the retail market. Regrettably, the authority has found that the use of corresponding hedging instruments in the futures markets is not sufficiently available in Estonia. Electricity traders in Estonia and the Baltics can no longer trade futures on the liquid Finnish market due to a bottleneck between the price regions. In June 2021, the Estonian Competition Authority and the Finnish regulator imposed an obligation on the system operators (Elering and Fingrid) to establish additional financial instruments at the Finnish-Estonian border as soon as possible. This should allow electricity traders to offer customers fixed electricity packages with better hedged risks. It also recommends that electricity traders offer their customers more active consumption management options.

Consumption management helps to bring down electricity market prices, but is currently a largely unused potential

Electricity traders could be more proactive in offering their customers consumption management options, which would allow the flexibility in consumption to sell directly to the day-ahead electricity market. This is an energy-saving measure with strong potential to bring prices in the market down significantly for all consumers during critical hours of ultra-high prices.

Unconsumed electricity, in its planned form and as a supply, carries exactly the same weight in the electricity market as the supply of production capacity, but only if that supply is presented to the market and can participate in the development of the market price. If consumption is reduced outside the market, the saving is only for the individual consumer, but does not affect the price on the exchange, as the exchange assumes that the consumer will consume as usual, i.e., the electricity trader will still buy the electricity from the market for them.

Reducing consumption outside the market is known as indirect consumption management, and can be handled by any consumer with an exchange package by ‘smart consumption’, shifting their higher consumption from higher-priced hours to lower-priced hours, for example, by doing their laundry at night. There are also smart devices that do this automatically and more conveniently for the consumer, according to the market price. In addition, some consumers also use small-scale production and storage systems that allow them to direct their consumption from the grid to cheaper hours. All this is very welcome and will allow consumers to make significant savings in the current volatile price environment. However, as mentioned, these approaches do not directly reduce the market price on the exchange, although they could. This is unused potential in the sense of the exchange.

In the Baltic States and Finland on 7 December 2021 at 8.00–9.00 a.m. at the historically high price of 1000 EUR/MWh per hour, we saw that there was a significant drop in consumption in Estonia, with a difference of as much as 130.7 MWh compared to planned consumption. This volume accounted for around 9% of Estonia’s total consumption in a given hour. Thus, balance providers/electricity traders planned 9% higher consumption for the hour than it actually was, i.e., consumers behaved differently than expected. To some extent, normal planning errors can be found in the forecasts of balance providers all the time, which is normal, but not to this extent. However, taking very roughly, for example, the average difference between the forecast and actual consumption for the given day, which is 57 MWh, as a normal consumption forecast error, there is still an additional 73 MWh difference for the given hour, where actual production is lower, indicating that consumers voluntarily reduced their consumption.

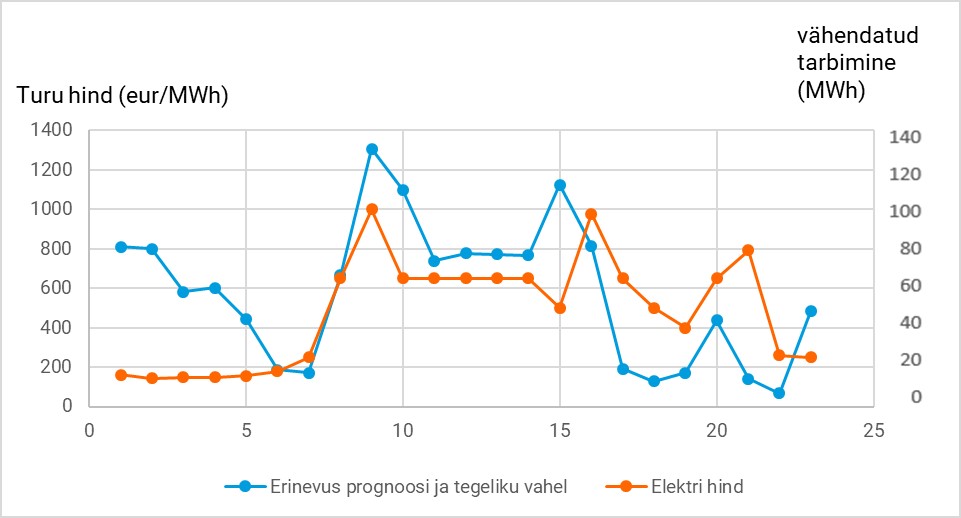

Figure shows the correlation between the decrease in actual consumption and the hourly electricity prices on the given day. We can see that, in fact, consumption for the whole day was actually lower than planned by the balance providers – the difference was the 57 MWh already mentioned. Particularly large gaps, however, can be seen between the hours of the highest market prices and their neighbouring hours, giving a clear indication that consumers themselves tried to reduce their consumption because of high prices. This shows that consumption in Estonia is price-sensitive and flexible and that consumers are open to managing their consumption according to price.

Figure. Indirectly, i.e. outside the electricity market, reduced dependence of consumption on price, 7 December 2021.

Market price (EUR/MWh)

Reduced consumption (MWh)

Difference between the prognosis and real consumption

Price of electricity

Thus, we can state that during the peak price hour of 8.00–9.00 a.m., the indirect consumption management in Estonia was in the range of approximately 130.7–73 MWh. Let us take as comparison the repair of 11 blocks at the Baltic Power Plant of Eesti Energia, which resulted in 142 MW of production being off the market on the same day. We can see that the size is relatively the same, the amount of reduced consumption is around 92–51% of the given capacity.

If this consumption flexibility were offered by the electricity traders to the electricity market as direct consumption management, i.e., price-dependent consumption, we would have had between 131 and 73 MW less demand on the market that hour at a price of 1,000 euros and there is a high probability that we would not have seen a market price of 1,000 EUR/MWh. Hence, in addition to specific consumers who did not want to consume electricity at such a high price anyway, who limited their consumption and thereby saved money, consumers in the Baltic and Finnish regions as a whole would have benefited significantly if this consumption flexibility had been offered to the market and the price had been lower (although the exact impact is difficult to say at this stage). A more structured use of flexibility and a more structured way of presenting the options to customers would probably further increase the potential for the amount of flexibility available. It would also be much more convenient for the consumer if their consumption was managed as a service and they did not have to switch off their appliances at certain hours.

In 2014, the Tallinn University of Technology carried out an analysis (PDF) commissioned by Elering to assess the potential of consumption management capacity in Estonia and the analysis established that it could be in the range of 214–407 MW per hour on average. Large users, who are able to bid on the exchange themselves, are already taking advantage of the opportunity to refrain from consuming when prices are high and would rather sell their non-consumption It is likely that it was the offer of some large users that also made the price of 1,000 EUR/MWh in the Baltic and Finnish regions during this hour, as the bidding curves of Nord Pool power exchange show a certain flexibility on the consumption side. In addition, the market surveillance of the power exchange operator Nord Pool pointed out that the price for the given hour was made by the flexibility of consumption. Without it, we would have seen even higher prices. The authority will, however, take a closer look at the bids for the given hour and, in cooperation with the market surveillance of the power exchange, will investigate the price formation for the given hour to specifically identify and verify the reasonableness of the price bid.

The European Directive on the internal market in electricity, adopted on 5 June 2019, introduces the principle that the management of consumption should be brought to all market levels in the Member States (i.e. including the day-ahead market), including by introducing a new electricity market participant – the independent aggregator – whose role would be precisely to aggregate and sell to the market the corresponding managed consumption. An independent aggregator can aggregate consumption from the portfolios of different balance providers/electricity traders at the same time, so larger quantities can be offered to the market.

In Estonia, the corresponding directive was transposed into the Electricity Market Act on 15 March 2022. The Competition Authority was given the task of setting up the conditions for participation in the demand response. At the same time, however, the legislation still needs to be improved so that functioning market rules and a market model can be created within the framework of the relevant conditions, and clear guidance is needed from the Ministry of Economic Affairs and Communications. In the vision of the authority, 2022 should see a strong focus on this issue to encourage the introduction of consumption management and aggregators at all market levels and the creation of market rules that work for all market players. The aim is to get a larger amount of consumption management into the market as quickly as possible, as this measure would allow the day-ahead market to bring prices down at critical hours when prices would otherwise go very high. In addition, if flexibility were offered directly to the market, the market model would allow flexible consumers not only to save on their flexibility, but also to earn a real return on it if it helped society by lowering the overall market price.

Therefore, there is currently no clear legislation or market rules for independent aggregators to operate in the day-ahead market. However, electricity traders can still offer their own in-portfolio consumption management to customers. The Competition Authority encourages Estonian electricity traders not to waste consumer potential, which can bring down prices on the market, and to broaden their product range also in the direction of consumption flexibility. At this point, it would be reasonable to create opportunities also for domestic consumers and not only for large users.

In the longer term, we need more production capacity in the region and better connections to fight high prices – all of which we also need to work on now, but which will take years to enjoy the benefits. A more skilful use of the potential of consumption flexibility could be done now and help us survive the transition. It is likely that the future electricity market, which we have already entered, will have highly volatile prices, and this will have to be played to the advantage of market players by changing the patterns of behaviour that have prevailed so far.